The Case of Alcoa

In the Power of Habit: Why we do what we do in business, Charles Duhigg shares the story of Alcoa when Paul O’Neill, former Secretary of the Treasury, became CEO. While this story has little to do with Certified B Corps and Benefit Corporations, it has everything to do with a focus on purpose and workers, and investor perceptions.

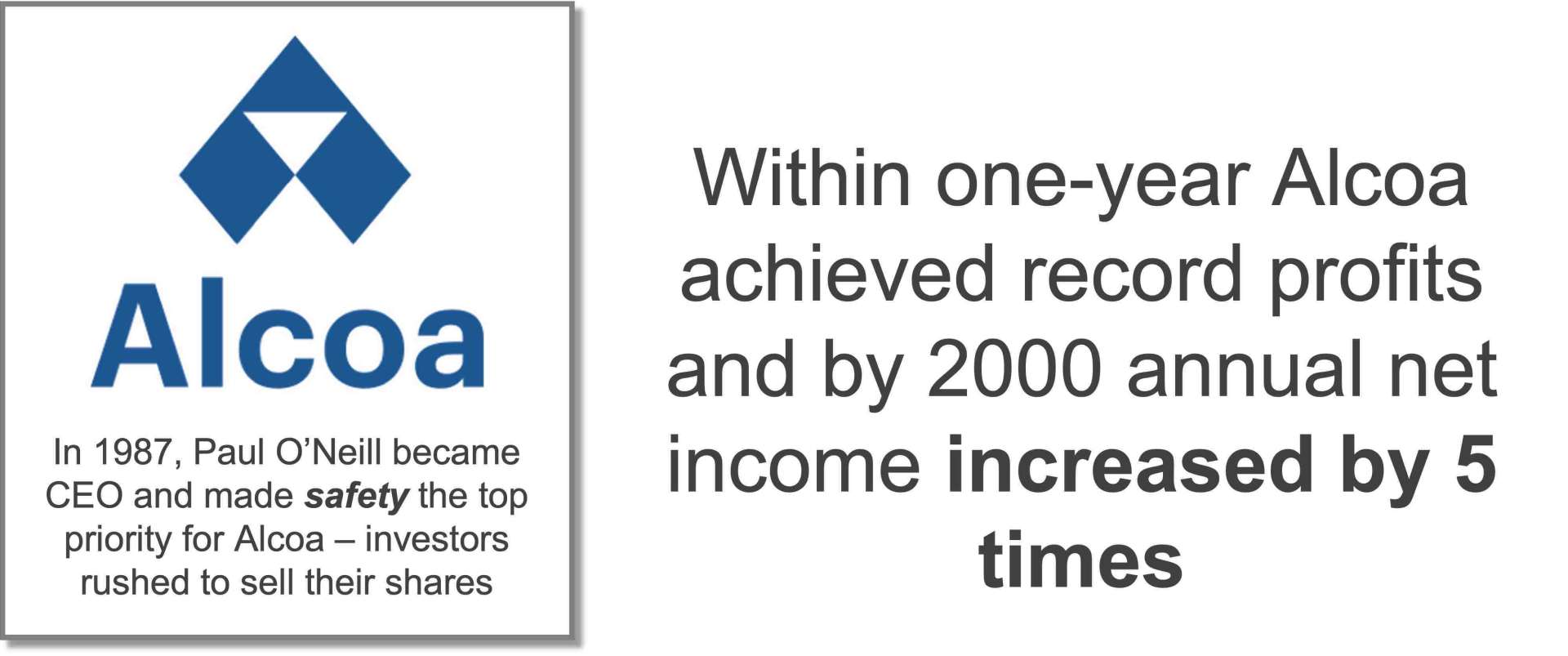

In 1987, Paul O’Neill was introduced as CEO at a shareholder meeting that included a large group of people with large investments in Alcoa. According to Duhigg, the shareholders were expecting O’Neill to talk about financial objectives and sales growth. They were expecting a traditional shareholder’s meeting that focused on how much money they should expect to make.

Instead, Paul O’Neill focused the entirety of his remarks on worker safety. He noted that on the job injuries had been increasing steadily and that the trend needed to be reversed. He never talked about financial results, he just hammered away on the importance of workplace safety, which is particularly important when employees are working with large machines and molten aluminum. At the end of his remarks, many investors rushed for the doors and sold their shares as quickly as possible. They all expected Alcoa to fail under O’Neill’s leadership.

Those investors would have done well to exercise patience. Throughout his tenure at Alcoa, Paul O’Neill significantly reduced workplace injuries with a relentless focus on safety. He remade the culture to the extent that when employees saw safety issues at worksites that had no connection with Alcoa, they would stop to educate workers on the importance of worksite safety. O’Neill created accountability up and down the organization and didn’t hesitate to fire top managers if they were unable to keep employees safe.

His focus on safety paid off in the form of financial results. Within one year Alcoa achieved record profits and by 2000 annual net income increased by 5 times. Investors who believed in Paul O’Neill’s strategy were rewarded handsomely by the end of his tenure.

During the early 2000s, there were a few companies (e.g., WorldCom, Enron) who showed high financial returns and ended up as large-scale failures that cost investors significant sums of money. Investors were attracted to these companies because of high returns. And as everyone knows, what was happening underneath the hood of these companies was far different from what the balance sheets reflected.

This experience and other changes in cultural and economic thought has changed how many investors evaluate companies. According to Ernst and Young, 97 percent of institutional investors evaluate nonfinancial disclosures when making future investment decisions, which includes evaluating commitments to social and environmental sustainability. The same report indicates that 89 percent “believe environmental, social and governance (ESG) will become more valuable in the event of a market downturn or correction”.

The B Corp movement is, to me, a product of a general improvement in our understanding of economic behavior. Through greater appreciation of the real motives that drive and excite people, B Corporations provide a significant new opportunity for investors. I think they could make more profits than any other types of companies…

-Robert Shiller, Sterling Professor of Economics, Yale University, & Nobel Laureate

Investors have good reason for their belief. A study by Arabesque Partners, an asset management firm, included a review of over 200 sources. Their analysis showed that 90 percent of the sources indicated that sound sustainability standards lowered the cost of capital, 88 percent showed that solid sustainability practices resulted in better operational performance, and 80 percent demonstrated that stock prices are positively influenced by good sustainability practices. Certified B Corporations emphasis on sustainability puts them squarely amid these numbers.

To support these numbers, in 2018 Danone showed the power of their sustainability commitments when they renegotiated the margin on their syndicated credit facility. They directly tied their environmental and social performance to the cost of credit – if they achieve their goals credit rates remain low, if they miss their goals credit rates increase per the agreed upon terms. Danone staked their commitments to the cost of credit and successfully convinced their banking partners to buy-in.

B Lab quietly offers investors … the first window into the DNA of a sustainable business for analysts and diligence professionals who know nothing about sustainable business.

-Matthew Weatherley-White, Managing Director and Owner of The Caprock Group

The B Corp model is regarded as the most-effective way to evaluate purpose-driven commitments. Few (if any) other assessments provide the breadth, and as Matthew Weatherley-White mentions, the B Impact Assessment and B Corp certification makes it easy for investors and professionals, who have limited knowledge about social and environmental sustainability, to evaluate a company’s practices. That investors look at a company’s score is testament that investors and shareholders have a positive view and, in many cases, don’t need to be fully-educated on the merits of the approach.