There Are Detractors

The main theme of negative perceptions focuses on Benefit Corporations and the Mission Lock component of B Corp certification, specifically that considering all stakeholders creates challenges for Boards of Directors and that the legal structure is not required to maintain a company’s mission. Each of these arguments have merit and should be considered.

The first argument is that codifying social purpose into Articles of Incorporation create undesirable burdens. Shareholders with just a 2 percent stake can challenge whether a company is making progress on their mission. This challenge could be to ensure that the company is succeeding with the purpose-driven strategy. In other cases, the shareholder may challenge the validity of the mission and claim it is impeding growth. This puts pressure on Boards to justify prioritization of all stakeholders.

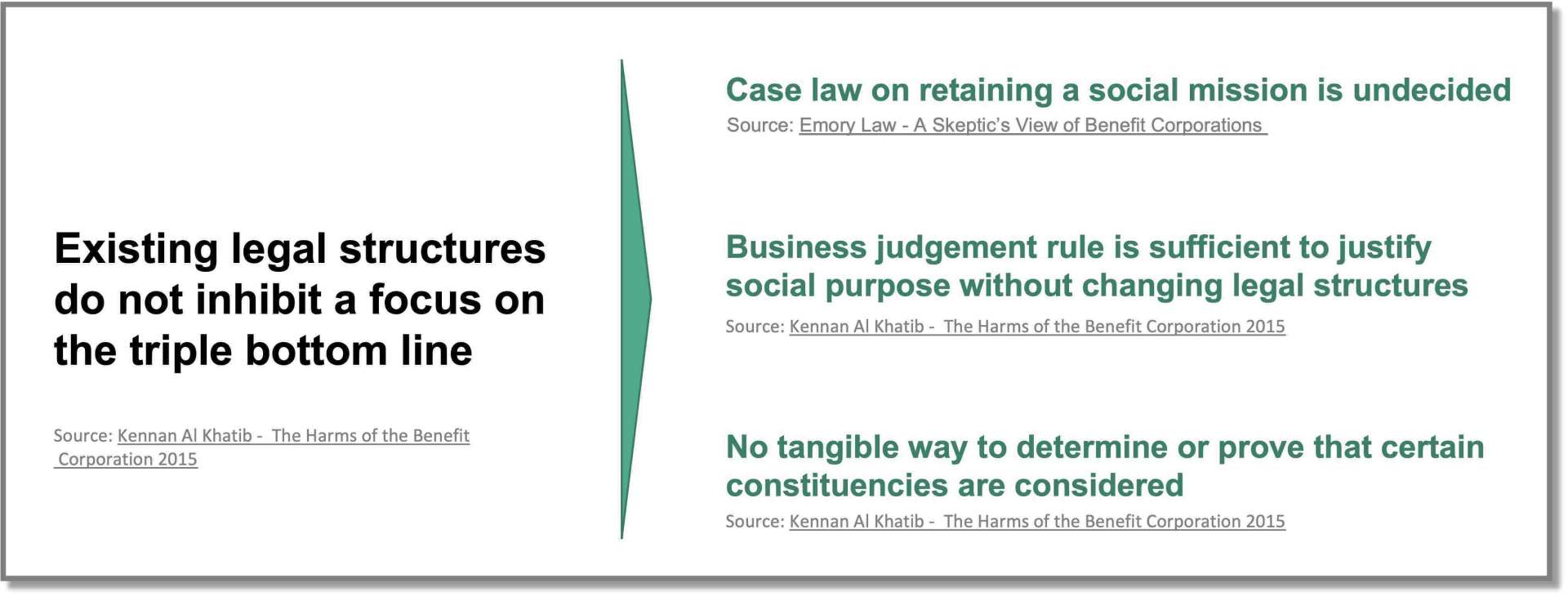

Benefit Corporations have increased reporting requirements requirements to demonstrate how their business supports all stakeholders. Traditional corporate structures require basic financial reporting. The focus on multiple stakeholders requires additional tracking and reporting. Simply signing B Lab’s contract acknowledging the company’s commitment to all stakeholders doesn’t necessarily create the same burden – impact reporting is an optional, though beneficial, practice. The article linked above, an article from Emory Law School, outlines six other reasons to be skeptical of the Benefit Corporation structure, including that they provide minimal value, that case law is undecided as to whether Benefit Corporations provide the promised protection, and that the legal structure potentially creates an incentive for bad actors – companies that retain a traditional legal structure and use their pure profit motive as a signal to shareholders who are focused exclusively on financial gain.

The second argument may be the most interesting and compelling. Kennan Al Khatib, a law professor at American University Washington College of Law, posits in a 2015 law review article that existing legal structures do not inhibit a focus on the bottom line. She says that the common belief that existing law requires corporations to prioritize profit over all else – shareholder primacy – is often misinterpreted. The legal case Dodge v Ford Motor Company in 1919 is regarded as the start of shareholder primacy. Keenan notes the “doctrine simply states that a company that elects to incorporate as a traditional for-profit serves primarily to maximize profits for its stockholders” and the company can decide how to achieve that objective. She also indicates that “the court narrowly held that a corporate policy that intentionally seeks to reduce profits is invalid as a matter of law”. In other words, for-profit companies exist to make money and not lose money, but the ruling does not prohibit a company from considering the well-being of other stakeholders. The article cites additional case law that supports the notion that existing corporate legal structures provide the necessary leeway to prioritize multiple stakeholders.

While seemingly innocuous, the benefit corporation fosters a harmful dichotomy with traditional for-profits that encourages consumers to evaluate companies based on legal status instead of business practices.

-Keena Al Khatib, Professor of Law, American University Washington College of Law

A key reason for this perspective is business judgement, the notion that Boards of Directors and company executives have the purview to make decisions about how a company should be managed to achieve and maintain profitability. If a purpose-driven model is the chosen business strategy, shareholders and other groups will have limited legal basis to challenge the approach. This also applies when a company elects to pursue a sale. A company that chooses a lower bid to preserve their mission may face legal challenges from higher bidders. However, Kennan Al Khatib argues that prior case law provides little basis for any lawsuit. In some cases, the selling company may have to litigate the challenge, but they will most likely win the case.

There is a small cohort, including Al Khatib, that suggest the B Corp movement and Benefit Corporations are simply another form of greenwashing. A key complaint about the B Impact Assessment is that it only awards positive points with no points subtracted for policies and practices that are contrary or antithetical to the model. For instance, it is possible to score high on Workers and Community, while maintaining practices that might be questionable from an environmental perspective.

The table below summarizes data that Keenan Al Khatib uses to demonstrate that Benefit Corporations may be a legal form of greenwashing. In 2015, only two B Corps were incorporated in Delaware, and the remaining 820 were incorporated in other states. Yet, Delaware had 39 Benefit Corporations that same year. While this comparison does not prove that any of those 39 companies were using the legal structure disingenuously, it does raise the question of why none of those Benefit Corporations had pursued the B Corp certification.

The detractors have valid points, and there is little doubt that some certified B Corps aren’t as altruistic or purpose-driven as the model intends. But that’s the case with all certifications or evaluations – none of them are perfect.

There has been a growing chorus within the B Corp community that the standards are not stringent enough and need to be strengthened. While B Lab has continued to update the assessment since its inception – we are now on version 6 – they are overhauling the assessment and associated standards to make them more rigorous. Beginning in 2024, companies interested in certifying will need to meet a set of baseline requirements to even be considered. By strengthening the requirements, B Lab may start to convert some of the detractors.